Tax planning strategies are literally the only reason I’m not currently stress-eating an entire large Domino’s right now thinking about last year’s tax return. I mean it. February 2026, sitting here in my freezing home office (thermostat says 67 but feels like 52 because the vents are blocked by moving boxes we still haven’t unpacked from last summer), and I’m actually trying to get ahead this time instead of my usual April 14th panic. Last year I owed $4,200. Four. Two. Zero. And change. Because I did exactly zero tax planning strategies ahead of time. Just crossed my fingers and hoped HR block’s free edition would miracle me out of it. Spoiler alert: it didn’t.

So this year I’m doing five things that actually seem to be working. Or at least they’re making me feel slightly less doomed. These aren’t sexy CPA-level moves. They’re just the ones a regular dude with a 1099 side gig, two kids who keep needing new shoes, and way too many subscriptions can actually stick to.

1. Cranking the 401(k) Contribution Before I Chicken Out Again

I used to do the bare minimum for the match—4% or whatever. Felt smart. Then I read somewhere that each extra percent lowers your taxable income and future-you thanks you. So last open enrollment I bumped it to 14%. Then in January I secretly nudged it to 17% because the paycheck didn’t hurt as bad as I thought.

- 2026 max is $23,500 under 50, I’m aiming for at least $20k this year

- Company matches 50% up to 6%—that’s basically a 50% return instantly

- Lower AGI sometimes gets me better child tax credit phase-outs or whatever

True story: first paycheck after the bump I legit thought direct deposit was broken because it was like $180 less. Almost called HR to complain. Then I remembered. Oops.

2. Bunching All the Charity in One Giant Dump Year

Used to give $50 to this, $100 to that, never hit the itemized threshold. Pointless. So last November I saved up donations and did one fat $5,100 transfer to our church food pantry plus dropped off like eight trash bags at Goodwill. Felt excessive. Felt good. Actually itemized for once.

News Flash • Palmdale, CA

This tax planning strategy only makes sense if you’re hovering near the standard deduction anyway ($14,600 single, $29,200 joint for 2026). But when you cross it—chef’s kiss.

I still have the receipt magneted to the fridge like a trophy. Tax planning strategies Next to a note that says “buy less energy drinks.”

3. Tax-Loss Harvesting (aka Finally Selling the Loser Stocks I Pretended Were “Long Term Holds”)

My brokerage account looks like a crime scene from 2021–2022. Down bad on a few individual names and one particularly cursed ARK ETF. I used to just ignore it. Now every December I sell enough losers to offset gains and take the extra $3k ordinary income offset.

Did about $8,700 in losses last December. Shaved roughly $1,800–$2,000 off the bill depending on bracket. Then waited 31 days and bought back similar index funds. No wash sale violation. Felt like a tiny criminal mastermind.

Downside? I still feel emotionally attached to some of those tickers. Like letting go of an ex who was bad for you but you miss the drama.

[Insert inline image placeholder: red portfolio screenshot with my finger strategically blocking the account number]

4. Finally Using the HSA Like It’s Supposed to Be Used

High-deductible plan. $4,150 individual limit for 2026. I let three years of contributions just sit there earning 0.8% or whatever trash interest. Then last year I started paying doctor bills out of pocket, saving receipts in a shoebox like my grandma used to, and reimbursing myself tax-free when I need cash.

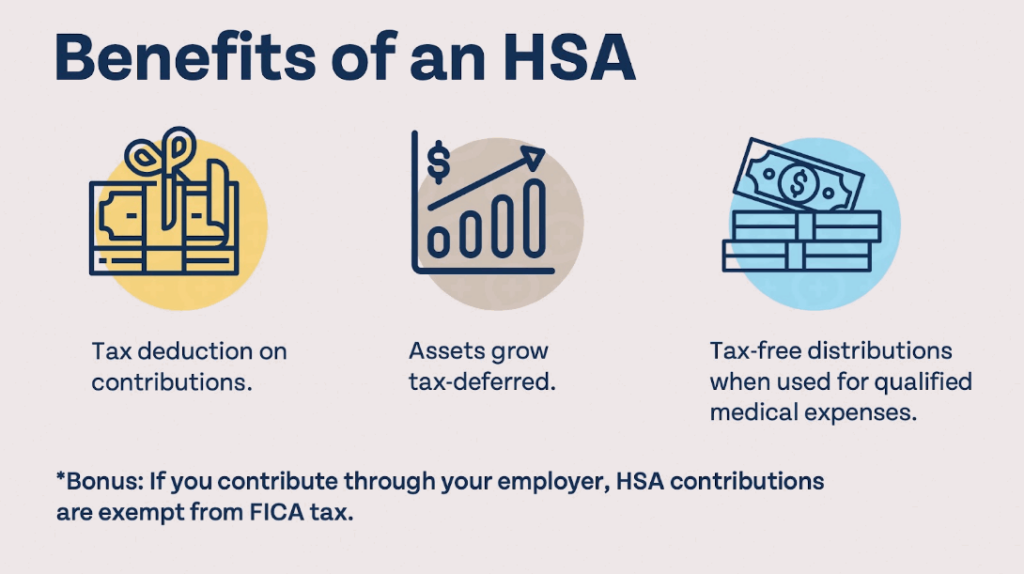

It’s the triple tax cheat code nobody talks about. Contribute pre-tax, grow tax-free, withdraw tax-free for medical. Or after 65 pretend it’s a traditional IRA. I just dumped another $2,800 in January. Felt boring. Felt powerful.

Money Guy’s Top Tax Planning Strategies | Money Guy

Comparing HSA to FSA, emphasizing the triple tax edge:

Start Maximizing Your Insurance for Therapy in the New Year

An overview framing it as a triple-tax-free retirement tool:

The Triple-Tax-Free Account You Might Be Missing – HSA Overview

Still haven’t reimbursed myself for the 2023 urgent care visit. Receipt is somewhere in that shoebox. I’ll find it. Eventually.

5. Timing Income and Expenses Like a Semi-Competent Adult

Side hustle checks. Sometimes I get a fat $6k invoice in late December. Used to deposit it immediately. Now if I think next year will be higher bracket, I ask clients to pay January 5th instead. Defers the tax hit.

Opposite direction: Tax planning strategies if I know a big RSU vest is coming, I prepay January’s property tax in December or make an extra mortgage payment to pull deductions forward.

Tried this in 2024. Overdid the prepayments. Got Alternative Minimum Tax whiplash. Owed anyway. Lesson learned: run actual numbers first, don’t just guess.